If your reading this, I want to shift your thought to why your hear. If you give me the next 5 minutes I will give you a path to double your online income in the healthcare sector.

I will show you a path to double your online income, even if you’re already doing over $1M a year in the healthcare sector. The bigger the better 🙂

Jeff 972-800-6670

If you have spent any time or money trying to leverage the billions of searches a day on google to your benefit, you have probably learned and done a ton of things and I Have you ever asked or thought:

- I wished I could get a link from ____________

- If I had a link from ________ it could double my authority and amplify my income.

- I wished I had a friend at ____________ who could get me a XXXXX.

- I wished I had the budget to buy a $6995 NY Times Authority Article

- I wished I would of never bought __________ service that got me a ton of junk links.

- _________was a waste of money and did not move the needle on my online business.

Why you should keep reading? I have spent the last 20 years of my life starting, growing and selling companies leveraging these concepts, and have built an entire livelyhood of providing access to the hardest to get authority to create tens of millions in value.

Here is what others have to say about the process. We can make an impact in every sector, but I personally specialize in Healthcare, Biotech, Government and Insurance.

Your still reading, good.

The next thing we need to do is set the stage. I get your the expert in your space, and I expect that. I can’t make you an expert or make you the best, I can only amplify good stuff.

With that said, if your an expert or all ready making money online in the healthcare sector (YOUR an expert if your making money) I can help. You probably have heard and responded to the following concepts, and if not please go figure these things out (FOR FREE-JUST GOOGLE THEM) and then come back and hit me up when you need me. It is ok, now may not be the time but if you stay at this long enough you will be calling me.

I have had people call me up to 9 years later ready for help. So its not if, just when….

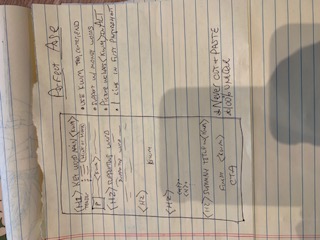

The Perfect Page for SEO

CONTENT IS KING: You have heard “content is king” and if your like most spent time creating content, and you need to do that. NO DOUBT, thats not my thing..just google it…call me when you have as many or more pages that the competitor you want to beat. Give me a call and I can tell you who you should search and listen too. Brian, Will…they have it wired!

ON-PAGE SEO: That’s right their is a science to creating content, and using every tool out there to figure out the top keywords, the value of those words and how they should be placed on the page.

PAGE LOAD SPEED: This is important, and you are probably already doing this if your a large company but here is a quick check list:

- be on your own dedicated server, not just for speed but the shared servers have other sites on them and google looks at these sites as your friends and neighbors and you do not want to live in a bad neighborhood.

- Understand the faster your pages load, the more pages the spiders will get to…you only get so much server capacity and want to give the spyders as much time to get as much as possible. (SITE MAPS ARE GOOD HERE)

- If you have multiple brands, understand how to interlinke them?

BACKLINKS: (you need to earn them). BUYER BEWARE: not all links are created equal.

If you are not currently taking advantage of all your own internal link equity, please google it. There are several people and companies that can help you.

I created over 1 million new eyeballs to a website by just doing this correctly, so do it. THIS SHOULD BE A PRIORITY!!!

Google Money Word or call me and I will point you to Bruce or Rand….

GAME CHANGER LINK: How to determine the perfect back link, the one link that can really move the needle.

QUALITY over Quantity…you probably already know this concept too but here is an example.

YOUR ADVANCED SEO KNOWLEDGE: Simple test: If you are not 100% sure you will pass this test then you do need to make sure you fully understand why you are doing what your doing. Tons of educational videos on this topic.

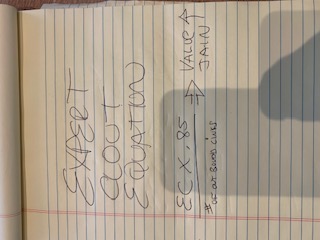

EXPERT CLOUT (Another need to know concept)

SAMPLE: Understanding that a page that has say a expert clout value of 1000 and is a perfect match or the top authority to your niche linking to you passes 85% of it’s EC / how how many out-boud many links on that page.

There is an easy equation to undersatand the MATHMATICAL VALUE of the EC you recieve from a link.

You’re still reading or you jumped ahead….great, just a few more concepts you already need to know before you engage me.

QUALITY OVER QUANITitY: it is much better to get a link from someone or some page that is directly your AUTHORITY.

SPEED OF LINKS MATTER: It is not natural to get links to fast , unless your a NEW PRODUCT or CURE you typically get links over time so….be smart.

NOW THE GOOD STUFF:

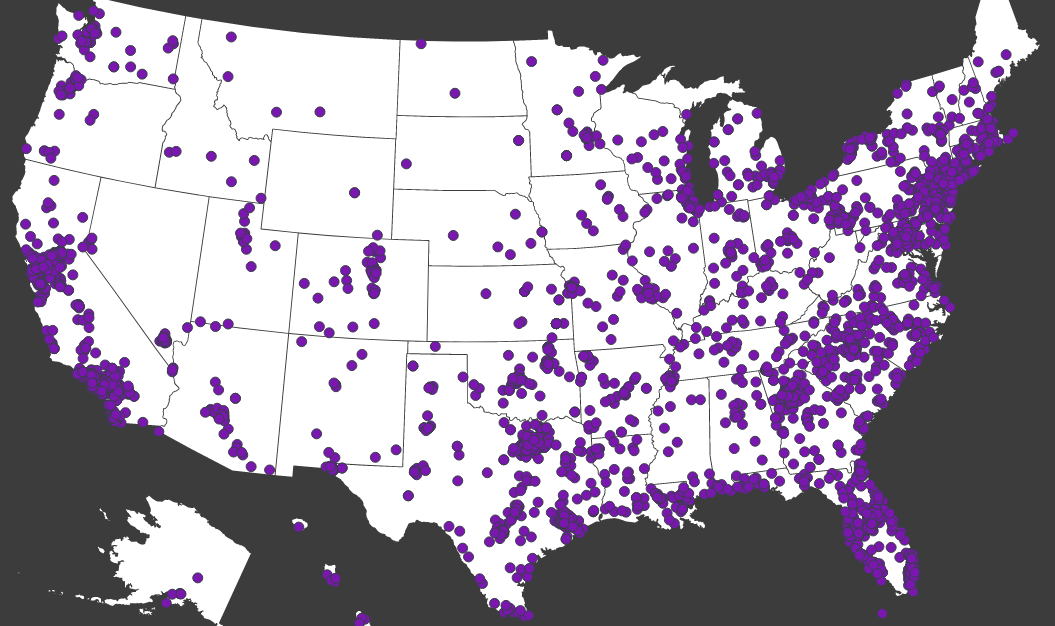

Top 500 Healthcare Links You Can’t Buy but want!

| 1 | nytimes.com | 93 | 86 | 2 | 2018-08-14 0:58:22 | 1,430,779 | 290,389 | 51,230,194.00 | |||

| 2 | cdc.gov | 93 | 100 | 12 | 2019-01-13 7:27:49 | 638,988 | 14,975 | 23,761,162.00 | |||

| 3 | constantcontact.com | 92 | 161 | 69 | 2018-05-26 2:20:09 | 285,104 | 122,356 | 1,021,855.00 | |||

| 4 | ca.gov | 92 | 172 | 2 | 2020-08-30 0:19:58 | 318,097 | 34,688 | 20,009,391.00 | |||

| 5 | washingtonpost.com | 92 | 194 | 1 | 2020-08-30 3:05:29 | 721,638 | 141,124 | 21,622,481.00 | |||

| 6 | springer.com | 92 | 291 | 1 | 2019-10-09 7:18:56 | 288,183 | 257,779 | 5,445,495.00 | |||

| 7 | prnewswire.com | 91 | 366 | 3 | 2020-04-26 20:35:31 | 237,561 | 514 | 3,718,136.00 | |||

| 8 | wikihow.com | 91 | 423 | 1 | 2019-01-20 12:28:48 | 242,675 | 59 | 24,528,281.00 | |||

| 9 | hhs.gov | 91 | 464 | 26 | 2018-07-31 6:20:03 | 146,747 | 9,595 | 1,989,908.00 | |||

| 10 | healthline.com | 91 | 470 | 1 | 2020-08-26 12:51:34 | 192,529 | 21,227 | 107,699,357.00 | |||

| 11 | texas.gov | 91 | 561 | 12 | 2018-11-13 9:47:57 | 113,890 | 26,428 | 7,282,132.00 | |||

| 12 | biomedcentral.com | 91 | 686 | 1 | 2019-02-10 7:32:28 | 143,914 | 81,507 | 1,700,190.00 | |||

| 13 | cambridge.org | 90 | 710 | 2 | 2020-07-30 20:20:42 | 177,800 | 81,949 | 48,783,058.00 | |||

| 14 | umn.edu | 90 | 841 | 2 | 2019-07-20 10:00:26 | 178,590 | 63,479 | 2,714,202.00 | |||

| 15 | wisc.edu | 90 | 958 | 1 | 2019-07-10 23:58:08 | 167,456 | 68,771 | 2,321,462.00 | |||

| 16 | web.fc2.com | 90 | 1102 | 6 | 2019-07-02 7:52:42 | 99,597 | 468,909 | 3,398,200.00 | |||

| 17 | cms.gov | 90 | 1129 | 21 | 2018-06-13 21:02:01 | 61,451 | 1,460 | 1,231,749.00 | |||

| 18 | aarp.org | 90 | 1134 | 2 | 2019-05-31 12:11:16 | 93,513 | 65,928 | 4,061,093.00 | |||

| 19 | medicare.gov | 90 | 1169 | 16 | 2019-09-26 7:18:41 | 58,869 | 270 | 2,059,321.00 | |||

| 20 | virginia.gov | 90 | 1402 | 3 | 2018-08-28 18:07:41 | 70,435 | 12,842 | 3,261,917.00 | |||

| 21 | in.gov | 90 | 1488 | 18 | 2019-06-27 11:49:52 | 68,834 | 16,933 | 2,976,947.00 | |||

| 22 | medscape.com | 89 | 1584 | 2 | 2020-05-25 15:19:18 | 94,005 | 19,530 | 5,543,622.00 | |||

| 23 | federalregister.gov | 89 | 1693 | 8 | 2020-04-10 9:39:46 | 53,133 | 14,094 | 316,673.00 | |||

| 24 | oregon.gov | 89 | 1730 | 2 | 2020-07-16 5:03:50 | 59,116 | 9,203 | 1,999,670.00 | |||

| 25 | govdelivery.com | 89 | 1752 | 1 | 2020-04-23 15:10:31 | 51,128 | 55,427 | 50,044.00 | |||

| 26 | leparisien.fr | 89 | 1765 | 2 | 2019-07-23 14:49:49 | 74,996 | 32,750 | 9,857,083.00 | |||

| 27 | maryland.gov | 89 | 1811 | 2 | 2019-06-30 23:54:29 | 55,758 | 17,158 | 2,142,604.00 | |||

| 28 | mo.gov | 89 | 1829 | 2366 | 2017-12-15 5:53:29 | 60,001 | 10,753 | 3,110,462.00 | |||

| 29 | fool.com | 88 | 2000 | 5 | 2019-07-05 23:47:16 | 93,926 | 93,372 | 5,155,743.00 | |||

| 30 | justia.com | 88 | 2076 | 2 | 2020-03-07 5:01:47 | 68,732 | 65,187 | 3,283,410.00 | |||

| 31 | georgetown.edu | 88 | 2232 | 1 | 2019-10-09 21:40:29 | 78,972 | 29,038 | 1,102,064.00 | |||

| 32 | tn.gov | 88 | 2294 | 2 | 2018-07-31 6:31:40 | 44,151 | 7,213 | 1,862,411.00 | |||

| 33 | hrw.org | 87 | 2426 | 3 | 2019-09-22 1:54:43 | 94,590 | 17,211 | 911,302.00 | |||

| 34 | verywellhealth.com | 87 | 2503 | 8 | 2019-06-14 11:54:35 | 75,487 | 2,265 | 4,894,329.00 | |||

| 35 | mn.gov | 87 | 2627 | 3 | 2019-06-27 22:41:07 | 40,370 | 8,576 | 1,007,265.00 | |||

| 36 | uiowa.edu | 87 | 2760 | 3 | 2020-06-04 20:55:23 | 76,900 | 24,952 | 1,005,254.00 | |||

| 37 | missouri.edu | 86 | 3118 | 1 | 2020-05-22 19:55:31 | 60,121 | 29,457 | 741,678.00 | |||

| 38 | delaware.gov | 86 | 3126 | 9 | 2018-10-16 21:01:14 | 36,946 | 7,518 | 581,187.00 | |||

| 39 | wisconsin.gov | 86 | 3128 | 1 | 2019-01-27 10:33:06 | 42,166 | 7,911 | 967,887.00 | |||

| 40 | propublica.org | 86 | 3241 | 1 | 2020-04-28 5:46:15 | 64,281 | 13,150 | 740,509.00 | |||

| 41 | wbur.org | 86 | 3432 | 3 | 2018-11-06 3:17:55 | 62,170 | 59,245 | 695,489.00 | |||

| 42 | nxtbook.com | 85 | 3830 | 4 | 2019-11-20 18:30:48 | 21,851 | 80,986 | 35,401.00 | |||

| 43 | myregisteredsite.com | 85 | 4035 | 4 | 2013-09-13 21:27:05 | 34,046 | 126,325 | 23,917.00 | |||

| 44 | buffalo.edu | 85 | 4103 | 1 | 2020-06-07 4:09:13 | 64,798 | 28,742 | 801,314.00 | |||

| 45 | sd.gov | 85 | 4116 | 2 | 2018-01-16 7:36:44 | 26,142 | 4,862 | 374,347.00 | |||

| 46 | aafp.org | 85 | 4143 | 2 | 2019-03-15 1:42:11 | 36,793 | 4,609 | 1,571,702.00 | |||

| 47 | louisiana.gov | 85 | 4347 | 6 | 2016-07-10 2:19:58 | 30,349 | 8,739 | 457,939.00 | |||

| 48 | la.gov | 85 | 4424 | 4 | 2020-03-11 9:18:30 | 26,069 | 4,477 | 686,843.00 | |||

| 49 | medicalxpress.com | 84 | 4738 | 2 | 2018-04-15 1:43:23 | 50,888 | 17,619 | 418,269.00 | |||

| 50 | allenpress.com | 84 | 5670 | 2 | 2020-07-24 3:00:50 | 23,751 | 4,416 | 41,235.00 | |||

| 51 | lexology.com | 83 | 6965 | 1 | 2017-09-17 5:11:08 | 23,391 | 50,581 | 362,319.00 | |||

| 52 | state.nv.us | 82 | 7065 | 22 | 2020-06-12 20:20:22 | 17,477 | 7,646 | 148,169.00 | |||

| 53 | healio.com | 82 | 7091 | 19 | 2019-07-06 16:23:38 | 23,912 | 11,436 | 723,804.00 | |||

| 54 | ks.gov | 82 | 7740 | 4 | 2017-04-06 7:48:27 | 19,570 | 3,514 | 330,760.00 | |||

| 55 | psmag.com | 82 | 8017 | 1 | 2020-05-26 9:40:20 | 32,461 | 25,147 | 90,830.00 | |||

| 56 | umanitoba.ca | 82 | 8472 | 1 | 2020-06-04 7:40:47 | 27,664 | 21,324 | 385,014.00 | |||

| 57 | drugfree.org | 81 | 9087 | 2 | 2020-08-16 16:18:48 | 24,105 | 1,728 | 108,736.00 | |||

| 58 | sdu.edu.cn | 81 | 9640 | 2 | 2019-11-01 21:49:53 | 19,431 | 8,126 | 14,343.00 | |||

| 59 | aha.org | 81 | 10175 | 30 | 2020-06-07 20:19:35 | 13,434 | 3,722 | 57,399.00 | |||

| 60 | commonwealthfund.org | 80 | 10676 | 14 | 2019-09-26 21:06:05 | 17,413 | 2,657 | 114,503.00 | |||

| 61 | nursingworld.org | 80 | 10832 | 2 | 2020-01-22 6:14:30 | 12,580 | 2,990 | 312,910.00 | |||

| 62 | healthday.com | 80 | 10988 | 4 | 2015-05-20 22:48:55 | 20,163 | 3,523 | 110,188.00 | |||

| 63 | state.tn.us | 80 | 11379 | 2 | 2020-08-10 9:27:21 | 15,849 | 6,658 | 32,973.00 | |||

| 64 | upmc.com | 80 | 12228 | 4 | 2016-12-25 20:46:17 | 15,639 | 3,186 | 865,709.00 | |||

| 65 | truthout.org | 80 | 12564 | 1 | 2018-09-02 23:10:24 | 43,364 | 38,880 | 35,920.00 | |||

| 66 | ahcancal.org | 80 | 12619 | 16 | 2016-03-24 21:27:45 | 7,693 | 477 | 19,779.00 | |||

| 67 | nbcphiladelphia.com | 79 | 13181 | 1 | 2020-09-02 19:13:53 | 29,715 | 18,163 | 314,284.00 | |||

| 68 | blr.com | 79 | 15291 | 6 | 2020-07-17 19:59:37 | 10,249 | 7,819 | 108,349.00 | |||

| 69 | mckesson.com | 78 | 16280 | 2 | 2018-01-19 7:28:47 | 7,670 | 1,440 | 353,909.00 | |||

| 70 | eventscribe.com | 78 | 16307 | 6 | 2014-08-01 14:18:00 | 5,256 | 15,906 | 22,783.00 | |||

| 71 | rismedia.com | 77 | 21416 | 3 | 2016-05-06 20:29:05 | 10,979 | 7,244 | 23,649.00 | |||

| 72 | posthaven.com | 77 | 23003 | 28 | 2019-04-29 8:26:51 | 3,747 | 48,423 | 3,516.00 | |||

| 73 | nhpr.org | 76 | 24505 | 1 | 2020-08-22 13:20:10 | 10,743 | 12,710 | 90,060.00 | |||

| 74 | kenyon.edu | 76 | 24716 | 1 | 2015-06-25 11:26:18 | 13,403 | 6,222 | 261,144.00 | |||

| 75 | ezvid.com | 76 | 29106 | 1 | 2020-09-03 9:52:10 | 7,836 | 9,578 | 569,906.00 | |||

| 76 | leadingage.org | 75 | 32459 | 43 | 2017-03-26 11:18:44 | 3,524 | 3,343 | 7,469.00 | |||

| 77 | springermedizin.de | 75 | 33127 | 1 | 2020-08-05 13:00:07 | 2,739 | 42,463 | 98,736.00 | |||

| 78 | civilbeat.org | 75 | 35021 | 1 | 2020-04-17 17:37:49 | 7,927 | 10,866 | 58,710.00 | |||

| 79 | uams.edu | 75 | 35976 | 2 | 2019-01-23 10:23:26 | 6,371 | 3,703 | 89,666.00 | |||

| 80 | ocgov.com | 74 | 37307 | 21 | 2017-04-04 11:13:04 | 4,604 | 3,804 | 196,292.00 | |||

| 81 | state.in.us | 74 | 38403 | 18 | 2013-09-25 14:10:37 | 5,613 | 9,084 | 114,818.00 | |||

| 82 | alleghenycounty.us | 74 | 38600 | 2 | 2020-04-30 0:39:24 | 3,965 | 1,760 | 186,409.00 | |||

| 83 | ecri.org | 74 | 39191 | 3 | 2020-01-08 1:08:46 | 2,950 | 472 | 7,589.00 | |||

| 84 | mcknights.com | 74 | 41781 | 34 | 2020-04-23 6:07:22 | 4,506 | 7,218 | 12,047.00 | |||

| 85 | ndhealth.gov | 73 | 48627 | 2 | 2017-06-30 13:20:51 | 3,869 | 612 | 43,096.00 | |||

| 86 | hhnmag.com | 73 | 52587 | 2 | 2017-10-31 14:51:20 | 5,247 | 1,997 | 615.00 | |||

| 87 | wiredforchange.com | 73 | 54478 | 10 | 2018-05-26 0:40:11 | 9,053 | 17,575 | 1,623.00 | |||

| 88 | lawprofessors.typepad.com | 73 | 54739 | 16 | 2019-03-10 14:49:00 | 9,893 | 39,651 | 16,590.00 | |||

| 89 | siteprice.org | 73 | 55393 | 12 | 2019-09-16 6:40:55 | 3,429 | 2,281 | 26,873.00 | |||

| 90 | publicnewsservice.org | 73 | 55528 | 2 | 2019-04-28 17:13:26 | 5,702 | 8,619 | 8,353.00 | |||

| 91 | wypr.org | 73 | 55719 | 1 | 2019-01-10 8:21:19 | 3,481 | 19,080 | 20,383.00 | |||

| 92 | ochealthinfo.com | 72 | 57030 | 6 | 2020-04-30 22:17:11 | 3,236 | 838 | 29,480.00 | |||

| 93 | wuwm.com | 72 | 57838 | 1 | 2018-05-25 23:54:27 | 6,035 | 22,931 | 40,591.00 | |||

| 94 | prlog.ru | 72 | 60163 | 125 | 2019-11-18 6:40:31 | 7,436 | 35,036 | 8,119.00 | |||

| 95 | ashe.org | 72 | 61608 | 8 | 2020-06-07 19:48:55 | 1,525 | 3,014 | 6,549.00 | |||

| 96 | knpr.org | 72 | 62531 | 1 | 2018-05-20 16:24:31 | 4,907 | 42,120 | 27,902.00 | |||

| 97 | nursingcenter.com | 72 | 63833 | 3 | 2020-02-29 6:57:32 | 4,652 | 9,287 | 249,235.00 | |||

| 98 | pbn.com | 72 | 63849 | 2 | 2020-05-27 14:14:30 | 3,822 | 1,030 | 8,104.00 | |||

| 99 | wbfo.org | 71 | 73151 | 1 | 2020-09-03 5:50:33 | 5,311 | 9,217 | 35,452.00 | |||

| 100 | theconsumervoice.org | 71 | 83467 | 14 | 2018-07-05 23:57:51 | 1,768 | 620 | 4,447.00 | |||

| 101 | wfsu.org | 71 | 86758 | 1 | 2020-04-25 12:55:44 | 3,582 | 12,034 | 20,147.00 | |||

| 102 | vermontbiz.com | 71 | 86854 | 2 | 2018-05-12 6:36:41 | 3,490 | 9,935 | 28,674.00 | |||

| 103 | ktoo.org | 71 | 87033 | 1 | 2020-03-07 1:10:03 | 4,302 | 8,174 | 22,583.00 | |||

| 104 | ref.ac.uk | 70 | 90858 | 3 | 2018-10-23 17:46:05 | 2,293 | 15,809 | 7,853.00 | |||

| 105 | mcknightsseniorliving.com | 70 | 92320 | 2 | 2020-08-25 12:38:50 | 2,017 | 3,907 | 6,818.00 | |||

| 106 | gpbnews.org | 70 | 95041 | 1 | 2020-06-23 1:56:36 | 3,175 | 8,622 | 732.00 | |||

| 107 | rnao.ca | 70 | 95125 | 73 | 2018-05-06 5:49:44 | 2,022 | 1,329 | 24,760.00 | |||

| 108 | ltcombudsman.org | 70 | 95740 | 2 | 2016-12-23 3:31:09 | 1,542 | 287 | 4,263.00 | |||

| 109 | ai.org | 70 | 96221 | 16 | 2017-04-25 19:58:43 | 2,394 | 8,838 | 7,547.00 | |||

| 110 | medicareadvocacy.org | 70 | 98957 | 22 | 2014-07-16 15:41:10 | 2,472 | 910 | 17,219.00 | |||

| 111 | healthjournalism.org | 70 | 99412 | 24 | 2019-02-28 4:37:26 | 2,456 | 6,368 | 6,015.00 | |||

| 112 | journalofhospitalmedicine.com | 70 | 103955 | 1 | 2020-04-06 22:37:15 | 1,160 | 1,149 | 20,055.00 | |||

| 113 | upmc.edu | 70 | 107412 | 4 | 2019-05-22 3:22:33 | 2,855 | 782 | 33,868.00 | |||

| 114 | saludcastillayleon.es | 70 | 107693 | 2 | 2018-05-24 22:28:41 | 2,392 | 2,517 | 582,848.00 | |||

| 115 | marcumllp.com | 69 | 114317 | 21 | 2018-04-01 2:50:11 | 1,781 | 1,094 | 14,529.00 | |||

| 116 | ocparks.com | 69 | 114364 | 3 | 2019-07-20 0:23:35 | 2,827 | 478 | 33,592.00 | |||

| 117 | crisisprevention.com | 68 | 120952 | 2 | 2015-11-21 21:10:04 | 1,640 | 1,001 | 63,083.00 | |||

| 118 | edenalt.org | 68 | 122267 | 1 | 2019-03-20 0:50:47 | 1,044 | 448 | 2,281.00 | |||

| 119 | rightathome.net | 68 | 124118 | 1 | 2017-01-07 10:59:33 | 2,303 | 3,315 | 36,594.00 | |||

| 120 | vcuhealth.org | 68 | 124359 | 2 | 2017-08-19 16:30:32 | 1,618 | 650 | 77,515.00 | |||

| 121 | div12.org | 68 | 128541 | 2 | 2014-08-05 23:17:07 | 1,230 | 387 | 17,548.00 | |||

| 122 | nprillinois.org | 68 | 129131 | 1 | 2020-04-26 15:32:18 | 3,358 | 15,633 | 22,127.00 | |||

| 123 | doctorslounge.com | 67 | 136225 | 2 | 2018-04-20 22:17:42 | 5,263 | 229,876 | 2,562.00 | |||

| 124 | qioprogram.org | 67 | 138160 | 134 | 2019-09-29 0:41:25 | 828 | 755 | 12,176.00 |

THE PROMISE:

RECAP: I will show you a path to double your online income, even if you’re already doing over $1M a year in the healthcare sector. The bigger the better 🙂

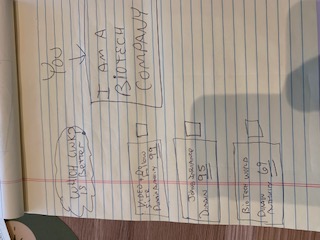

If you are competing in a space that is super competitive like healthcare, biotech, or insurance I have already done it. I have earned over the last 20 years links from all the top CLOUT sites in these sectors to build , launch, grow, run and even sell companies but I have kept the EXPERT CLOUT value and have the ability to help you leverage my years of hard work onto your business and transfer my expert clout to your business or project in a real step, by step process that can really move the bar.

Real Life Examples:

| Biotech Company | Broke 50,000 client referrals in one year, up from 5500 when they started with me. |

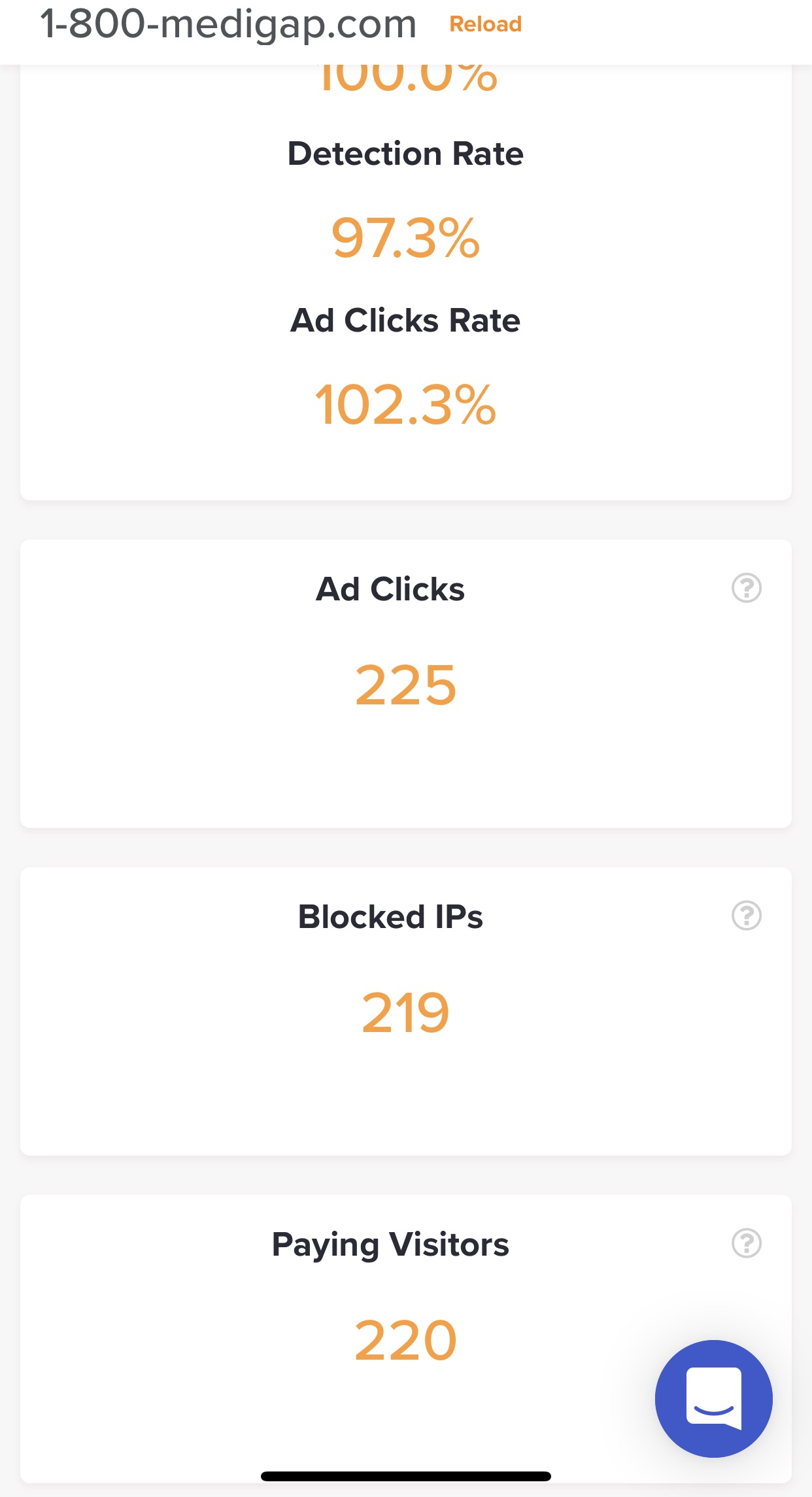

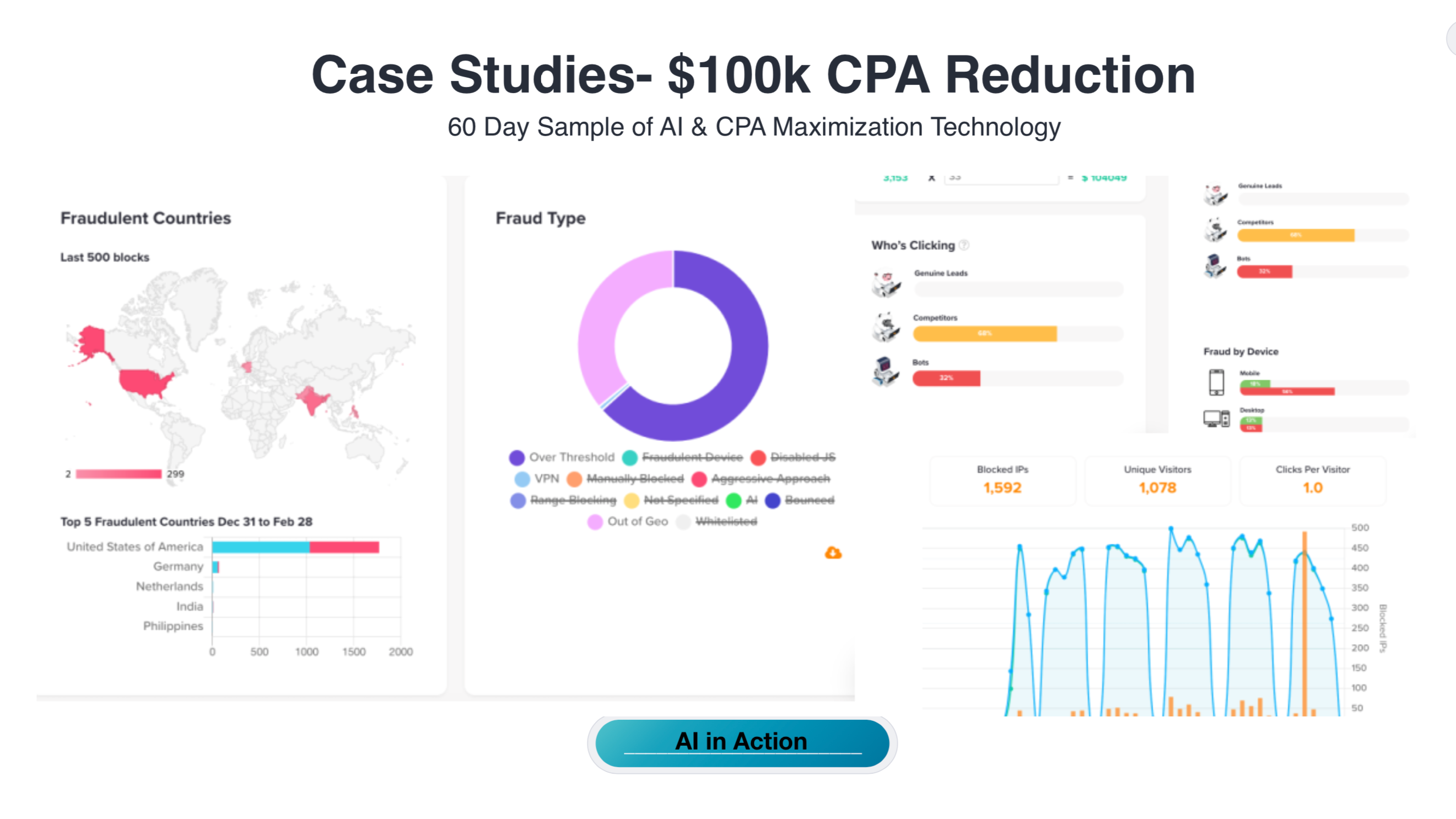

| Insurance Company | Has driven their cost per application from $790/per application to $420/per application thats a 47% change in their #1 KPI. |

BONUS CONTENT: Not only can I help you drive traffic I am en expert profit optimization consultant.

Profit Optimization Consultant

Many people call me a profit guru. God has blessed me with a unique way to see the world and business….below is an example of how not only did I help a company drive more revenue to their business but also reduced their #1 KPI

Ready to have a conversation? Above is the start…let me show you a way to additional $1,000,000 in revenue. “NO OBLIGATION -NO RISK” if you are excited about our first call and I can’t see a way to create a win-win I PROMISE NEVER TO CALL YOU AGAIN!!!!

Jeff Cline

Contact: 972 800 6670

If you are wondering about me, I am a father of of 4 and a grand father. Happily married to a super hot/amazing wife for over 25 years. (actually 50 anniversaries-if we become friends Ill tell you the story). I personally own and operate many successful businesses and a few not so successful.

My heart project(Where my skills and heart meet) is cuurio where our team is trying to change the world.

PLEASE WATCH THE VIDEO (JEFF CLINE non-Profit) CUURIO

Cuurio

Business as a mission : Changing the world